Taylor Swift is undoubtedly one of the most successful pop stars today, with record-shattering album sales, sold-out stadium tours, and a net worth crossing $1.5 billion.

But beyond her chart-topping music, Swift has proven herself an incredibly shrewd businesswoman. Through bold power moves and strategic partnerships, she has built an entire commercial empire extending far beyond catchy songs.

Let's examine Swift's key business plays that transformed her from musician to mogul:

Owning Her Master Recordings

In November 2020, Swift began re-recording her first six albums to regain ownership of her master recordings.

Masters are the original recordings that record labels own in perpetuity. By creating new masters, Swift aimed to diminish the value of her originals owned by her former label.

This daring gambit paid off tremendously. Swift's re-recordings of "Fearless" and "Red" both hit #1, outperforming even the originals. Fans flocked to hear new vocals and unreleased tracks.

Securing these re-recorded master rights ensures Swift finally profits from her earliest hits. Old albums generate revenue again through syncs and licensing. It was a boss move that put power and profits back in artists' hands.

Renegotiating Streaming Royalties

In 2014, Swift pulled her entire catalog from Spotify, publicly denouncing their paltry streaming royalties. Her move sparked debate about fair compensation for artists.

After Apple launched Apple Music, Swift negotiated a game-changing deal. Apple agreed to pay royalties during customers' free trial periods, setting a new industry standard.

In 2018, she left Big Machine Records and signed with Universal Music Group in a reported $300 million deal. This made her the highest paid artist at the time.

Swift flexed her star power again in 2021, working with Universal Music Group to license recordings to streaming platforms. Though terms remain private, Swift likely negotiated higher royalty rates given her commercial dominance.

Through staunch advocacy, Swift has defined fairer streaming economics for herself and fellow artists.

Launching High-Grossing Tours

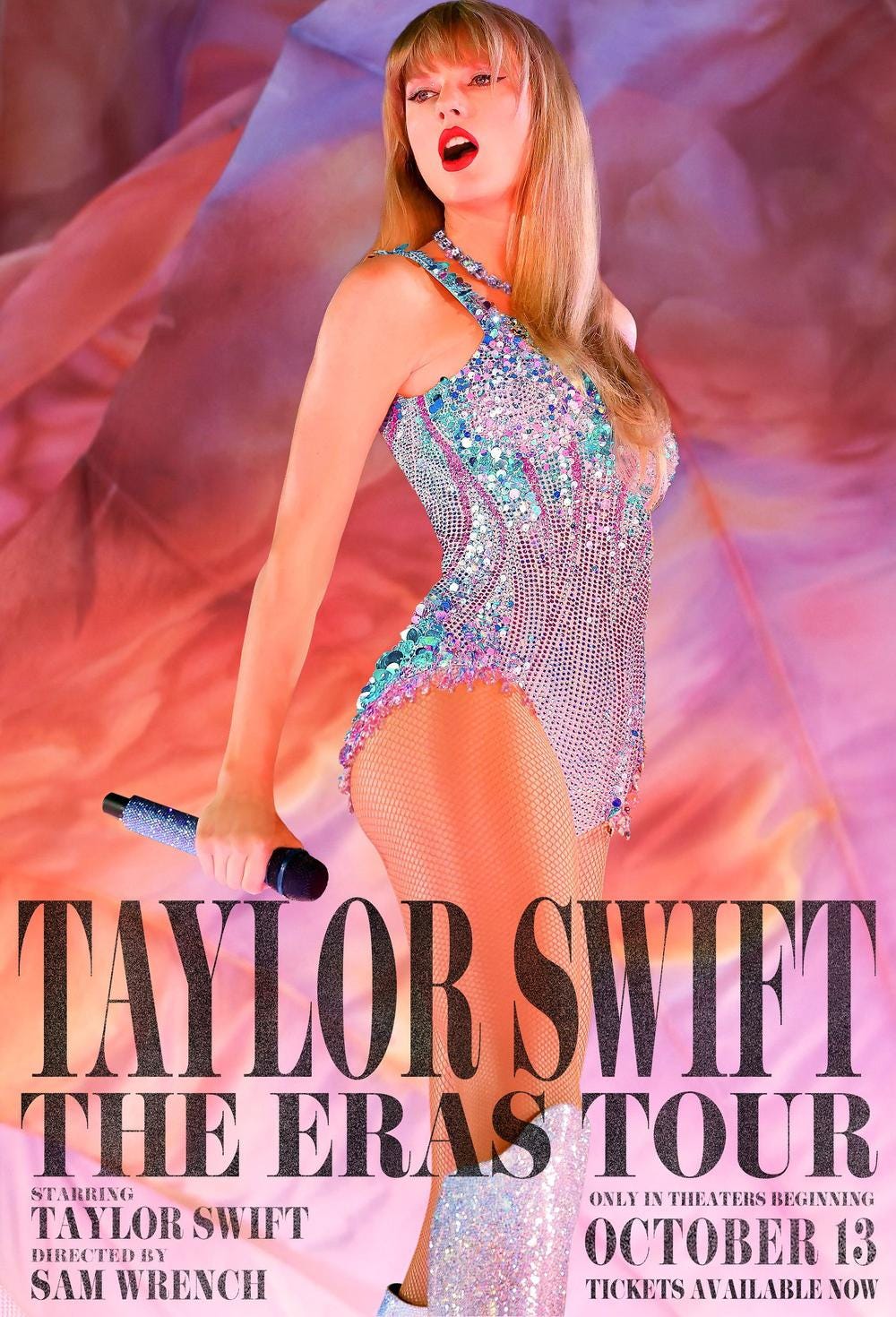

Swift's live shows are legendary for their scale and revenue. Her 2018 Reputation Stadium Tour was the highest-grossing U.S. tour ever by a woman, grossing $266 million.

Her 2023 Eras Tour has already grossed over $700 million globally, selling over 4 million tickets. It's on pace to become the highest earning tour of all time. Total concert grosses and merchandise could surpass $900 million after international dates. That will shatter the previous record of $733 million set by The Rolling Stones.

Swift also maximized ancillary income through merchandise and broadcast deals. She partnered with AMC Theatres to screen her tour show as a live concert film. The Eras Tour movie broke box office records for a music event, grossing $93 million globally.

On tour, Swift sells VIP packages and high-margin merchandise from phone cases to signed guitars. By producing an unforgettable live spectacle, Swift has made touring her most lucrative enterprise.

Investing in Real Estate

Beyond music assets, Swift has grown her fortune through savvy real estate investing. Her property portfolio includes lavish homes in Nashville, Rhode Island, Los Angeles and New York City worth over $100 million collectively.

Swift even turned a $6.5 million Beverly Hills estate she bought in 2015 into a historic landmark, increasing its value and saving millions in taxes. Her real estate empire represents diversified assets with impressive returns.

Maximizing Celebrity Brand Partnerships

As a top celebrity spokesperson, Swift has chosen lucrative brand deals that align with her public image.

Her 10-year partnership with Diet Coke earned a reported $26 million. She also had long-term deals with brands like Keds, AT&T, Apple and Target.

Recently, Swift collaborated with Peloton on a themed workout class. Her Midnights album release sparked a surge of Spotify and Amazon engagement.

Instead of oversaturating her brand, Swift makes selective endorsements that drive major value for partners.

Protecting Her Rights and Image

Swift aggressively protects her brand identity, trademarks, and song rights. She sued vendors for unauthorized merchandise sales and took on everyone from Justin Bieber to a Utah theme park for illegally using her lyrics.

After becoming a key advocate for artist rights, Swift ensured her Universal deal included ownership for all future masters. No detail escapes her control.

By fiercely safeguarding her music and image, Swift retains maximum authority over her catalog and earnings.

Connecting Directly With Fans

Swift's close relationship with her highly engaged fanbase is the secret sauce tying her empire together. She nurtures this connection through:

Constant social media interaction

Secret album listening sessions

Gifting custom merchandise to fans

Inviting devotees to parties

This genuine outreach sustains an avid supporter base who spend on albums, tickets, and merch while proudly repping their idol. Swift's bond with fans is her most valuable asset.

The Bottom Line

Swift's business acumen matches her artistic talent. By taking ownership of masters, negotiating fair streaming pay, maximizing touring and brand deals, investing in assets, and protecting her image, she has built an empire valued at probably ±$1.5 billion dollars.

Swift's empire shows what's possible when creative talent meets entrepreneurial vision. She sets the gold standard for converting musical success into commercial dominance. Simply put, Swift is as shrewd as business moguls come – and at 33 she's only just getting started.

Read our previous post: What do Starbucks, Lego and Nike have in common?